How chips, drought, and China link a tropical island nation with a desert state

At Safulak Café, in the hills outside Hsinchu on the island nation of Taiwan, you can get a free cup of coffee if you donate a book to their collection. The deck outside overlooks a large lake, winding into the distance surrounded by Taiwan Red Cypress and Japanese Blue Oak, and perhaps you’re regretting your hot latte in the humid summer afternoon. In 2021, however, the view was different: you could walk to the other side of the lake, with only the remains of a stream to jump across. The lake, really one of two reservoirs in Baoshan, had all but dried up in the face of the island’s worst ever drought.

In response to nationwide shortages, the government cut off the water supply to large portions of the agriculture sector, the country’s largest water consumer. Farmers were compensated for the resulting loss of income and spent their days waiting it out, wondering about the future of their work. (Two years later, rice farmers continued to be paid not to grow amidst further drought.) This was, to some degree, at the benefit of the semiconductor industry, which continued its water usage largely unabated.

How important are semiconductors to Taiwan?

Taiwan has the largest semiconductor manufacturing capacity of any country, producing half of the world’s chips. This is almost entirely down to a single firm, the Taiwan Semiconductor Manufacturing Company, or TSMC. Plenty of companies design computer chips, but as a general rule they use TSMC to fabricate them. Their output spans from the majority of chips that end up in cars, to every iPhone processor since 2018; Apple, by far the company’s largest customer, has recently bought up nearly all of TSMC’s manufacturing capacity for its newest, most advanced fabrication process.

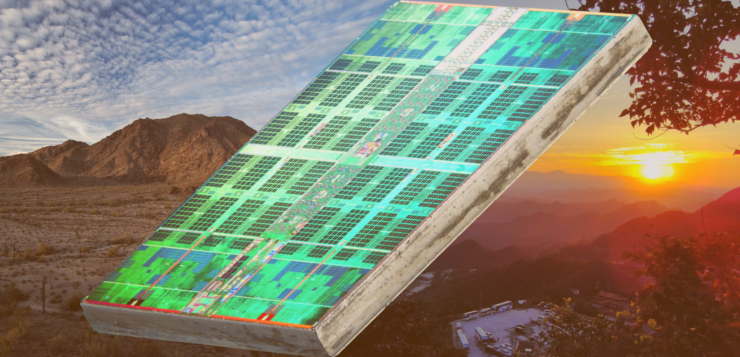

Semiconductor fabrication, it turns out, is an extremely water-intensive process. A thin, thirty centimetre wide circular wafer of silicon will enter a fabrication plant (‘fab’ for short) and undergo hundreds, if not thousands, of processing steps to create the intricate structures that give the silicon its behaviour, before it’s sliced up into rectangular chips and sent to the customer. Many of these are cleaning steps, washing the wafer of excess material with water. The tiny and precise nature of the circuits necessitates water of almost perfect purity to prevent contamination—in the most advanced processes, measurements can be made by counting atoms. All this adds up to TSMC’s consumption of over a quarter of a million litres of water every day. The Hsinchu-based fabs, like their agricultural and residential neighbours, source this water from the Baoshan reservoirs.

The looming threat of China

In the fight over the last drops of water, why then did chips win out over rice? Beyond the looming threat of further drought towers a more immediate threat, from Taiwan’s biggest trading partner. Nearby China claims the island as its own, an idea Taiwan’s government, and most of its population, reject. January’s election of Lai Ching-te of the incumbent pro-independence Democratic People’s Party as president demonstrates a desire for continued separation, if not official independence, and is a selection China has explicitly warned against. Recent escalations of both rhetoric and displays of military strength are leading to greater fears of invasion, which Taiwan would require major support to defend against. Here lies the ‘silicon shield’—through its dominance in the semiconductor supply chain, Taiwan has made itself invaluable to the United States, its main military ally. The ubiquity of semiconductor products, present in every electronic device in every industry, means the US economy relies on its ability to source them; so the theory goes, in the event of direct military action by China against Taiwan, the US has enough skin in the game to need to intervene, despite deliberate ambiguity on its position.

This reliance has the US worried. Semiconductor shortages underpinning global supply chain pressure over the past few years have highlighted the bottleneck of Taiwan; with both China and the climate threatening to disrupt its production capability it seems vital to diversify. The 2022 CHIPS Act (a horrendous backronym—Creating Helpful Incentives to Produce Semiconductors) has earmarked almost fifty billion dollars to re-shore chip production to the US after decades of decline. Companies after these new subsidies won’t be allowed to expand production in China, among other countries the US sees as national security threats, killing another bird with the same statutory stone. TSMC, not about to lose out on its market dominance, is one of those companies, standing to gain up to six billion dollars in subsidies for new fabs in the US.

TSMC’s Move to the States

In the desert heat north of Phoenix, Arizona, is the site where TSMC’s two new fabs are slowly taking shape. And slow is the word, with construction seemingly plagued by mismanagement and delays pushing operation closer to the end of the decade. Regardless, when both fabs come online they will account for about four percent of TSMCs annual output, largely supplying Apple, Nvidia, and AMD, whose CEOs all turned up at the announcement ceremony for the second fab in 2022. TSMC isn’t the only player in town however, with Intel’s Chandler campus on the other side of Phoenix also expanding, adding two more fabs to its existing four. Intel’s business has a different shape to TSMC’s—where TSMC fabricates other companies’ chips, Intel designs, fabricates, and sells its own, mainly in the personal computer processor space. Notably, their biggest competitor in that market is AMD.

Competition and subsidies breeding large construction projects that create tens of thousands of jobs, from steelwork to research and development, is surely a good thing, but the saguaros shimmering in mirages across from nearby housing developments hint at the other side of the coin.

The Phoenix metropolitan area sits in the Sonoran desert, North America’s hottest, over the Gila River drainage basin which drains into the Colorado River. Water supplied to the area is groundwater from the aquifers below, as well as surface water. The latter is partly from the local Salt River, but the bulk of the supply is from the Colorado itself, pumped hundreds of miles back uphill along a canal. Late to the game in getting access rights to Colorado water, Arizona is the first to have their allocation reduced when demand outstrips supply, an increasingly common situation with supply reduced by up to a fifth by 2050, as increasing temperatures reduce runoff into the river. Meanwhile, the current drought conditions affecting the river are into their twenty-fourth year. Combined with similar declining water levels in the Salt, this means the metro area’s access to groundwater is a major factor for its water security. The area also happens to be the fastest growing in the country; state officials say there isn’t enough groundwater to support much of the already approved new housing developments.

It seems an odd place to build more fabs, but for TSMC it was an obvious choice. Arizona has supported Taiwan’s position on the world stage through lobbying and trade deals since the ‘70s, and could no doubt rely on the support of Arizona for its venture onto US soil. Intel’s expansion is the result of forty years of presence in the state, and collaboration with local universities has ensured a large local talent pool that Intel, and now Taiwan, can take advantage of. Beyond this, the lack of water seems to be offset by other environmental benefits—no hurricanes, tornadoes, or earthquakes that budgets for construction elsewhere might have to take into account.

How Sustainable is the Manufacture of Semiconductors in Water Insecure Areas?

Both companies go to great lengths to justify their presence in areas of extreme water insecurity like Taiwan and Arizona. Intel in particular has the heady goal of “net positive water” by 2030, in which it funds water restoration projects globally that offset their fabs’ consumption. These projects are local as well as distant; one project involves, slightly patronisingly, helping Arizona farmers grow less water-intensive crops, while several support river conservation groups in Oregon near other Intel fabs. Philanthropy through effective ecological conservation funding should, in general, be welcomed.

Ultimately though it is not possible to offset a fab’s water consumption entirely through nearby water restoration; it takes a cumulative, distributed set of projects. Water security issues meanwhile have an intrinsically local effect—Intel’s help in the restoration of water levels in Lake Nanjapura, Nepal, will not ensure steady supply from the Colorado. The forced analogy with carbon emissions offsetting doesn’t hold so well in light of this. In fact even at the most local levels, the idea of water offsetting is fundamentally flawed. Water providers in Arizona have long allowed unsustainable draw from aquifers, provided that an equivalent amount of surface water is purchased to recharge an aquifer elsewhere in the metro area, as a technicality to build new developments in areas without secure groundwater supplies. This “paper water” usage further exacerbates existing inequities in water access the area.

A less abstracted way in which both Intel and TSMC are reducing water consumption is through water reclamation, allowing input water to circulate through the fabs more than once. In 2022, TSMC opened a reclamation plant supplying its fabs in southern Taiwan, reducing pressure on the area’s reservoirs. They claim that reclamation in its Arizona fabs will allow the them to “gradually achieve near zero liquid discharge,” though it’s not clear how soon this could happen. To varying degrees, other manufacturers are also increasing their water recycling efforts and are often reducing their overall consumption by considerable amounts. It’s a similar story with direct greenhouse gas emissions reductions in fabs; the processes involved are well placed for implementing extremely efficient measures to temper their environmental impact, at least on a per-chip basis.

The fact is, despite reductions in water consumption for each chip produced, expansions into Arizona and elsewhere in the US are a sign of rapidly increasing demand, and production is water-intensive by nature. Up to half of planned new fabs are set to be constructed in areas of high or extremely high water stress risk, where water withdrawals account for at least forty percent of the total available ground and surface water supplies. At the same time, semiconductor fabs enjoy regulatory immunity from water shortages, with irrigation water diverted to fabs in Taiwan while Intel and TSMC construction continues alongside abandoned housing developments in Arizona.

Increasing global temperatures will divert more typhoons away from Taiwan, causing reservoirs to dry up more frequently. So will they further drop the water level in the Colorado River, deteriorating ecosystems across swaths of the US and Mexico. With the expansion of semiconductor manufacturing outside of Taiwan, clearly more focus is needed on where the new fabs end up, even as water recycling methods become more ingrained. As one of the wettest places on earth dries up, there are lessons going unlearnt.